This week we have a guest blog from my friend, colleague and author of “Your Retirement, Your Way”, John Trauth

Net Worth vs Self Worth: Anxieties in Spending Your Retirement Paycheck

Congratulations! You saved diligently for your retirement for the last umpteen years. Whereas there were ups and downs in the markets and also in your investments, overall your money grew as you grew in your job. Everything was slowly getting better and better. It was a virtuous cycle.

You retire.

Whoops! Tilt. Freeze. Are you absolutely sure you have enough money to last for the rest of your life? Your financial advisor told you the numbers worked, but that was before this recent financial meltdown. But it’s more than just about money, isn’t it? You will start withdrawing funds from your retirement account(s). Your contributions will stop and your retirement savings will no longer grow like before. You will now be depleting your resources. And for many people that is a place where they get stuck–can I let myself be a spender rather than a saver?

And what about you? Are you no longer growing either? Or worse? Do people not value your opinion like they used to? Do your buddies at the office not call you anymore? Is your spouse getting sick and tired of having you around the house all the time?

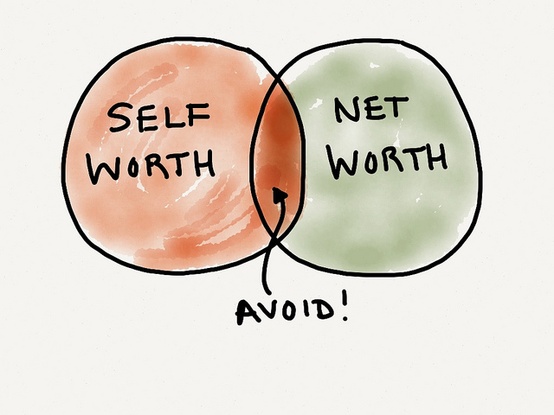

At a time when you should feel good about reaping the rewards of all your labor, instead you feel frustrated, off balance, stuck. As you deplete your net worth, are you also depleting your self worth?

Has the virtuous cycle turned into a vicious cycle?

Some people literally freeze at this juncture. They spend practically nothing, reduce their lifestyle to minimum levels, and worry constantly. This is not what retirement was supposed to be like!!! What’s going on here?

If you are getting stuck, there is a lot going on here that you probably don’t fully understand. For many people, the act of replacing saving with spending is connected, at a preconscious level with depletion. Have I started a downhill descent—the bottom of the hill being death—by taking my resources and spending them? We call this an “anxiety” because it a non-rational thought that we cannot fully make conscious. So, instead we replace it with worry. Do I really have enough money? Were my financial advisers really correct in their calculations? Rather than express the connection to our underlying fears of mortality, and that starting to spend our retirement funds, at an amount based on actuarial projections of our future longevity relates directly to our mortality, we allow ourselves endless worry about our net worth, never touching the deeper concern about entering into a phase of gradual physical demise.

Not resolving these conflicts can have dire results. Take the example of Dr. Phillips of North Carolina. A successful gynecologist, he retired from a highly successful career with a bundle of money from his savings augmented by the buyout of his share of the practice by his partners. It looked to all the world like he had it made. Three weeks later, he was found dead with a bullet in this head. He left a note which read, “Three weeks ago, I was Dr. Phillips. Today I am nobody!”

Dr. Phillips is an extreme case, but why is retirement such a difficult transition for so many people? Here’s why. Work gives you three important things. It gives you structure: when to get up in the morning, where to go, how long to stay there, when to come home. It gives you community: a group of like-minded people with whom to relate to during the day. And it gives you purpose: things to accomplish, and a sense of direction. These three things, structure, community and purpose, contribute to your sense if identity. When you retire, you are in danger of losing your identity if you don’t take action to recreate structure, community and purpose in your life. And you will want to do it in a way that will make you satisfied and fulfilled.

Retirement is not a perpetual vacation. Vacations are great, but as a counterbalance to a set routine. If you think you will be forever happy on a permanent vacation, think again.

It is better to think about all this before you retire. But if you haven’t, it is not too late. Regardless, begin by thinking about the times that you were happiest when you were working, when you were in a state of “flow” and lost all sense of clock time. What were you doing? Who were you with? What were the circumstances? What was the environment? Then think about how you might be able to recreate these experiences in your retirement life. Many people start a new career, or their own business. Others get involved with nonprofit organizations or otherwise help improve their local community. As a result, they continue to grow, learn, contribute and prosper personally if not financially.

So now let’s get back to the money part. Once you have rediscovered your passion(s) and created a meaningful life for yourself in retirement, you may or may not be earning an income from what you are doing. If you are, that’s great, because money is one way of valuing your efforts, and the more you earn, the less you will need to withdraw from your retirement savings. Merrill Lynch did a study which found that if you work only 30% of the time in the first five years of your retirement, your portfolio will be 40% larger at the end of that period than if you didn’t work, and it will need to cover five fewer years. Therefore, it will sustain a considerably higher lifestyle. The Center for Retirement Research has estimated that 45% of Americans will not be able to sustain their current lifestyle in retirement based on the amount they have saved. So this is a possible solution for these folks.

But regardless of whether or not you earn money in retirement, you need to change your mindset about spending your retirement funds. Before, you invested for your retirement. But now, as you spend those funds, you are investing in yourself. You are giving yourself the opportunity to grow and develop other aspects of your interests and personality that you previously never had time for. You are creating a wonderful “new life” for yourself. What better return on investment than that? Think of it this way. Any declines in your net worth will be more than offset by significant increases in your self worth!

George Schofield is a division of The Clarity Group, LLC© 2017 George Schofield. All rights reserved.

George Schofield is a division of The Clarity Group, LLC© 2017 George Schofield. All rights reserved.

4 Comments

Jari Searns

April 6, 2017 4:13 pm 0LikesHi John! You have just written an article about my Husband and described his dilemma to a tee…he’s a great guy who hasn’t yet retired as we own 50% of a business which our son and daughter-in-law are now running (with VERY great success I might add) and he is simply floundering around trying to look very busy and complaining about everything and everybody.

I am giving him your article to read…I hope to Heaven he does!!!

Rick Searns

April 9, 2017 6:17 pm 0LikesI read the article and liked it very much and hopefully it will help me when I decide if I will return or continue working and when I retire to decide how I will spend my time

George Schofield

April 10, 2017 6:32 am 0LikesThanks, Rick. Everyone has their personal spin on the process that works for them BUT I recommend you get a copy of John’s book. Florida is missing you two, especially the Lobster Dinner People. George

George Schofield

April 10, 2017 6:31 am 0LikesHi Jari,

I was glad you found my blog post insightful.

If you and Rick read my book and do the exercises (as it is really a workbook of sorts), I think that would help you both. The transition to retirement is one of the biggest of life’s transitions, as George and I both write and talk about, yet it is often underestimated in terms of the challenges it represents. Knowing those challenges and understanding ways to address them can provide a potential path to enjoying the years ahead. Good luck!

John Trauth